Introduction

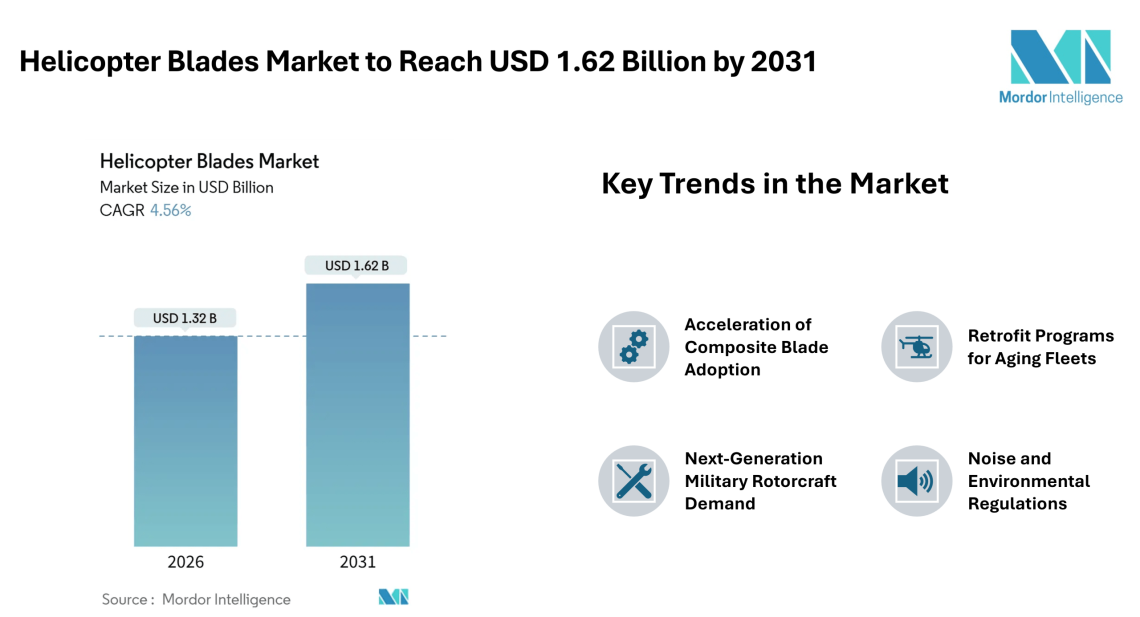

The Helicopter Blades Market size is projected to grow from an estimated USD 1.32 billion in 2026 to USD 1.62 billion by 2031, registering a CAGR of 4.56% during the forecast period. Growth is anchored in the accelerating shift from metal to composite blades, expanding retrofit activity across aging fleets, and next-generation military rotorcraft programs that require enhanced blade performance. Composite materials now account for most of the revenue, while automation in manufacturing is shortening production cycles, enabling suppliers to better meet delivery timelines. Demand is further supported by rising helicopter utilization in civil missions such as offshore crew transport and search-and-rescue operations, which drive higher blade replacement and service activity.

Key Trends in the Helicopter Blades Market

The following Helicopter Blades Market trends are shaping industry dynamics and future demand

Acceleration of Composite Blade Adoption

The market is experiencing strong adoption of composite materials, which deliver longer fatigue life and weight savings over traditional metal blades.

Retrofit Programs for Aging Fleets

Operators are increasingly choosing retrofit blade kits to extend airframe life cycles cost-effectively, supporting sustained aftermarket revenues even when new helicopter deliveries fluctuate.

Next-Generation Military Rotorcraft Demand

Defense modernization programs and future high-speed rotorcraft initiatives are creating demand for advanced blade technologies that can withstand higher loads and complex mission profiles.

Noise and Environmental Regulations

Strict noise and environmental standards are boosting adoption of advanced blade designs, such as swept-tip configurations that reduce acoustic signatures without compromising performance.

Digital Twin and Structural Monitoring Integration

The adoption of digital twin technologies and structural health monitoring systems is enhancing blade lifecycle management, enabling predictive maintenance and reducing downtime.

Market Segmentation

By Material

Composite blades held a leading share of the market in 2025, supported by their superior fatigue life, weight advantages, and growing adoption across civil and military fleets.

By Blade Location

Main rotor blades dominated revenue in 2025 due to their larger size and higher replacement frequency, while tail rotor blades are growing rapidly due to noise-compliance retrofits and conversions.

By Application

Military fleets commanded a larger share of the market in 2025, though civil applications are growing at a faster pace, driven by offshore support, search-and-rescue, and public service missions.

By Helicopter Class

Light helicopters generated the greatest revenue share in 2025, but medium helicopters are expected to grow faster as operators favor multi-mission utility platforms.

By Fit

Linefit installations accounted for the majority of revenue in 2025, while retrofit blades are expected to register the highest growth as operators extend service lives of existing rotorcraft.

By Geography

North America held the largest regional revenue share in 2025, supported by defense programs and large civil fleets. Asia-Pacific is projected to record the fastest growth rate through 2031, fueled by indigenous blade production initiatives and expanding helicopter operations.

Major Players

The Helicopter Blades Market is moderately concentrated, with both OEMs and specialized aftermarket providers competing on innovation and service breadth. Key companies include:

- Lockheed Martin Corporation

These players focus on advanced composite solutions, retrofit kits, and integrated service offerings to maintain competitive positioning as blade technology evolves.

Conclusion

The Helicopter Blades Market forecast indicates continued growth through 2031, supported by the transition to composite materials, expanding retrofit activity, and rising utilization in both military and civil missions. Technology developments such as digital health monitoring and noise-optimized designs are shaping future demand. While North America retains a leading position in market size, Asia-Pacific emerges as a high-growth region. Suppliers that combine cutting-edge materials, predictive maintenance capabilities, and retrofit solutions are well positioned to capture the evolving needs of global helicopter operators.

Industry Related Reports

Aerospace Composites Market: The Aerospace Composites Market report analyzes the industry across multiple dimensions, including fiber type such as glass fiber, carbon fiber, and others; resin type covering thermoset composites and additional variants; and manufacturing processes including filament winding and other methods. The report further segments the market by aircraft type, encompassing commercial aircraft and other categories, as well as by structural components such as interior components and additional applications. End-user segmentation includes OEMs and other user groups, while the geographical analysis covers North America and other regions. Market size and forecasts for all segments are presented in terms of value (USD).

Aerospace Carbon Fiber Market: The report provides comprehensive coverage of global aerospace carbon fiber manufacturers and analyzes the market by application, including commercial fixed-wing aircraft, military fixed-wing aircraft, and rotorcraft. It also evaluates the market across key geographical regions. Market size and forecasts for all segments are presented in terms of value (USD billion).

Aeroengine Composites Market: The Aeroengine Composites Market report analyzes the industry across multiple segments, including application areas such as commercial aircraft, military aircraft, and general aviation. It further categorizes the market by component, covering fan blades, fan cases, guide vanes, shrouds, and other components, as well as by material type, including polymer matrix composites and ceramic matrix composites. The report also segments the market by end user into OEM and aftermarket and provides a geographic analysis covering North America, Europe, and other regions. Market size and forecasts for all segments are presented in terms of value (USD).

About Mordor Intelligence

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/